Talking about rupee vs dollar downfall numbers, rupee was around 45 in last decade. How it just went from 45 to 68 that is the measure issue here. Depreciation in rupee starts after 2008 global economic crisis. In last two year rupee depreciates in 39 % of its original value and after 2013 April rupee depreciates by more than 20 % of its original value.

Consider we are exporting more goods than importing that mean we have more foreign currency inflows. Again What is foreign currency inflows? Foreign currency inflows mean we have more foreign currency with us. That means we have surplus account but that is not the case with India. We have terms know as current account deficit which got affected by the difference in import and export .Local sentiments about imported goods made our CAD(current account Deficit ) more widening and more concern about foreign short term debt.

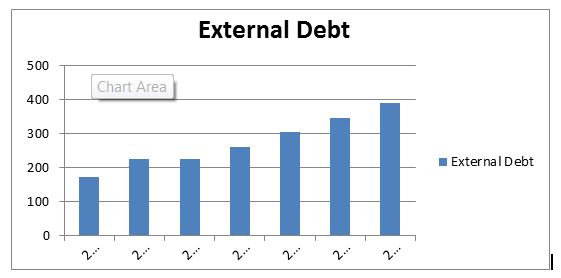

About financial terminology I will right another article. Bur because of widening of this CAD and foreign debt it put stress on Rupee constraint. We have 390$ billion external debt but more concern in our 172.3 $billion short term debt which is kindly 44.2 % of total external debt .Short term debt is a debt which we have to pay in 1 year or so. Our trade deficit and CAD also contributing in this fiasco of rupee depreciation.The only promising thing we have right now is the forex reserve .we have around 300$ billion forex reserve. Which will be our balance of payment for next 6 month 4 days be precise. So we have to shorten gap of CAD for very less. Another good thing is as our export has risen.But still RBI do not have answer to our Rupee’s downfall. Hope our new Governor For RBI will take action to curb Volatility of rupee.

Even social media steps up to tune rupee vs dollar downfall on their own way to lure the charms with Music.

What do you think about this image,

Its such as you learn my thoughts! You seem to know a lot

about this, like you wrote the ebook in it or something.

this is is wonderful blog.

An excellent read. I will definitely be back.